UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ Preliminary Proxy Statement

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ | Definitive Proxy Statement |

☒ Definitive Proxy Statement

☐ | Definitive Additional Materials |

☐ Definitive Additional Materials

☐ | Soliciting Material Pursuant to §240.14a-12 |

pSivida Corp.☐ Soliciting Material Pursuant to §240.14a-12

EyePoint Pharmaceuticals, Inc.

(Name of Registrant as Specified in itsIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ No fee required

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

☐ Fee paid previously with preliminary materials

| (2) | Aggregate number of securities to which transaction applies: |

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

480 Pleasant Street

Watertown, MA 02472

United States

November 13, 2017

Dear Fellow Stockholders,

It is our pleasure to invite you to a very important annual meeting of stockholders of pSivida Corp. (the “Company”), which will be held on Friday, December 15, 2017, at 9:00 a.m. U.S. Eastern Standard Time, at pSivida’s Corporate Headquarters, 480 Pleasant Street, Watertown, Massachusetts 02472, in order to vote on the proposals disclosed in the accompanying proxy statement.

Since my arrival at pSivida in September 2016, I, along with the Board of Directors and senior management, have worked diligently to establish a clear vision for pSivida. Our primary objectives are to become a fully integrated commercial stage pharmaceutical enterprise and to increase the utilization of our proprietary technology. In order to achieve these two objectives, which should result in increased stockholder returns compared to historical results, we set a number of near- and long-term goals. I am pleased to report that we have met or exceeded all of these goals first shared with you in late 2016:

We completed and reported that our three-year treatment for posterior segment uveitis successfully achieved its primary efficacy endpoint in the second Phase 3 study;

We consummated a Europeanout-license for our Durasert three-year posterior segment uveitis product candidate, transferring regulatory and commercialization responsibility in that territory to Alimera;

| • | | In addition, we further amended our existing Alimera collaboration agreement to convert the previous profit share arrangement for ILUVIEN® for DME to a tiered sales-based royalty, providing improved and more predictable long-term revenue generation; |

We have entered into three new feasibility study agreements with pharmaceutical companies for front of the eye (glaucoma) and back of the eye diseases. These agreements leverage our proven Durasert technology and expand potential future sources ofnon-dilutive funding; and

In collaboration with Hospital for Special Surgery (HSS), we completed patient enrollment in a Phase I investigator-sponsored study for pain relief of knee osteoarthritis (OA).

Our progress has accelerated and our trajectory has changed, for the better. The reprioritization of pSivida’s development and collaboration programs continues to increase the number of opportunities to accelerate our growth. Over the next few months, we have a number of key milestones, the most significant of which, of course, is filing our New Drug Application (NDA) for Durasert three-year posterior segment uveitis. We have received positive input from the U.S. Food and Drug Administration (FDA), are executing our submission plan and expect to file the NDA in late December 2017 or early January 2018. Other milestones include the12-month efficacy read out for our second Phase 3 study in the first half of calendar 2018 and, similar to 2017, we expect leading uveitis experts to continue presenting clinical study data at leading medical conferences and reinforcing positive clinical outcomes.

In addition to our Durasert three-year posterior segment uveitis product candidate, we are also excited about the potential for our shorter duration nine-month Durasert product candidate. We know retina specialists generally prefer drug treatments that offer multiple dosing options, and uveitis is no exception. Consequently, we believe this could have significant value to them as they treat their patients. In market research that we performed

and shared with you earlier this year, physicians were very favorably inclined to use both shorter-duration and three-year duration treatment regimens for their uveitis patients.

Most importantly, we have commenced commercial planning for our potential posterior segment uveitis launch in the U.S market that, assuming a normal FDA review period and approval, could occur as early as the calendar 2019 first quarter. As I have communicated previously, commercializing this asset directly in the U.S. requires upfront investment, but positions pSivida for long-term profitability and growth. We believe launching Durasert three-year posterior segment uveitis ourselves is critical to driving revenue, future profitability and stockholder returns. Furthermore, we have the leadership team in place to maximize the U.S. commercial opportunity, a team that has previously launched dozens of drugs and generated significant revenue. Uveitis, which is the third leading cause of blindness in the developed world, has a relatively modest prevalence and small number of specialized physicians who treat it. Therefore, we anticipate launching with a small, highly focused contract field force, thereby limiting our commercial cost outlays.

Our operating performance these past 12 months demonstrates that we are working hard to ensure that the Company’s potential is fully realized. We are optimistic that, if approved by the FDA, the combination of our low cost of goods and a fair price should allow us to achieve a profitable product within a few years from launch and to begin to provide our stockholders a better rate of return compared to our historical globalout-license strategy. We have proven technology, leadership andin-depth scientificknow-how, and I am confident in our ability to continue executing on our deliverables.

In connection with this annual meeting, all stockholders and holders of CHESS Depositary Interests (“CDIs”) are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, we urge you to submit your proxy card or CDI voting instruction form as soon as possible so that your shares (or shares underlying your CDIs) can be voted at the meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions on the proxy card or CDI voting instruction form.

We are delivering paper copies of our proxy materials to all of our stockholders and CDI holders. In addition, the Notice of Annual Meeting, proxy statement, proxy card and CDI voting instruction form are available on the following websites:www.edocumentview.com/PSDV for street holders andwww.envisionreports.com/PSDV for registered holders.

Your vote is very important and we encourage you to vote promptly and affirmatively for the proposals. As a Delaware corporation and under our bylaws, a minimum ofone-third of our outstanding shares of common stock (including shares underlying our outstanding CDIs) must be present in person or represented by proxy at the meeting in order for the meeting to be considered valid. You may vote your shares online, by telephone or by mailing a completed proxy card if you elect to receive the proxy materials by mail. Instructions regarding each method of voting are provided on the proxy card. CDI holders may vote the shares underlying their CDIs only by written instruction to the CDI depositary. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Yours sincerely,

Nancy Lurker

President and Chief Executive Officer

ii

This letter to stockholders includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You should be aware that our actual results could differ materially from those contained in the forward looking statements. Among the factors that could cause actual results to differ materially from those indicated in the forward-looking statements are risks and uncertainties inherent in our business including, without limitation: our ability to achieve profitable operations and access to needed capital; fluctuations in our operating results; successful commercialization of, and receipt of revenues from, ILUVIEN for diabetic macular edema, which depends on Alimera’s ability to continue as a going concern; Alimera’s ability to obtain marketing approvals and the effect of pricing and reimbursement decisions on sales of ILUVIEN; the number of clinical trials and data required for the Durasert three-year uveitis marketing approval application in the United States; our ability to file and the timing of filing and acceptance of the Durasert three-year uveitis NDA in the United States; our ability to use data in a United States NDA from clinical trials outside the United States; our ability to successfully commercialize Durasert three-year uveitis, if approved, in the United States; potentialoff-label sales of ILUVIEN for uveitis; consequences of fluocinolone acetonide side effects; the development of our next-generation Durasert shorter-duration treatment for posterior segment uveitis; potential declines in Retisert® royalties; efficacy and our future development of an implant to treat severe osteoarthritis; our ability to successfully develop product candidates, initiate and complete clinical trials and receive regulatory approvals; our ability to market and sell products; the success of current and future license agreements, including our agreement with Alimera; termination or breach of current license agreements, including our agreement with Alimera; our dependence on contract research organizations, vendors and investigators; effects of competition and other developments affecting sales of products; market acceptance of products; effects of guidelines, recommendations and studies; protection of intellectual property and avoiding intellectual property infringement; retention of key personnel; product liability; industry consolidation; compliance with environmental laws; manufacturing risks; risks and costs of international business operations; effects of the potential United Kingdom exit from the European Union; legislative or regulatory changes; volatility of stock price; possible dilution; absence of dividends; and other factors described in our filings with the Securities and Exchange Commission. You should read and interpret any forward-looking statements in light of these risks. Should known or unknown risks materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected in the forward-looking statements. You should bear this in mind as you consider any forward-looking statements. Our forward-looking statements speak only as of the dates on which they are made. We do not undertake any obligation to publicly update or revise our forward-looking statements even if experience or future changes makes it clear that any projected results expressed or implied in such statements will not be realized.

iii

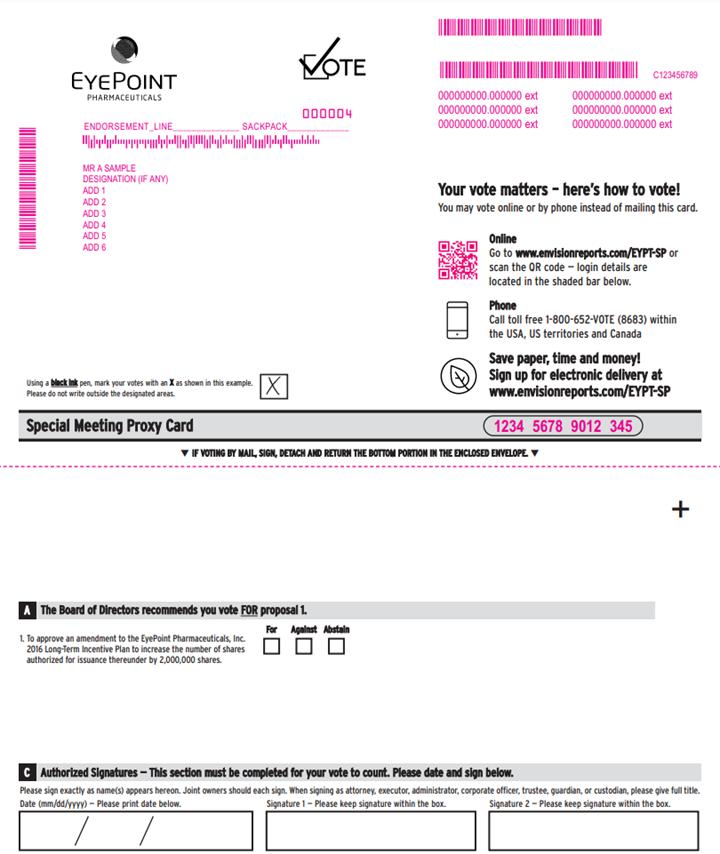

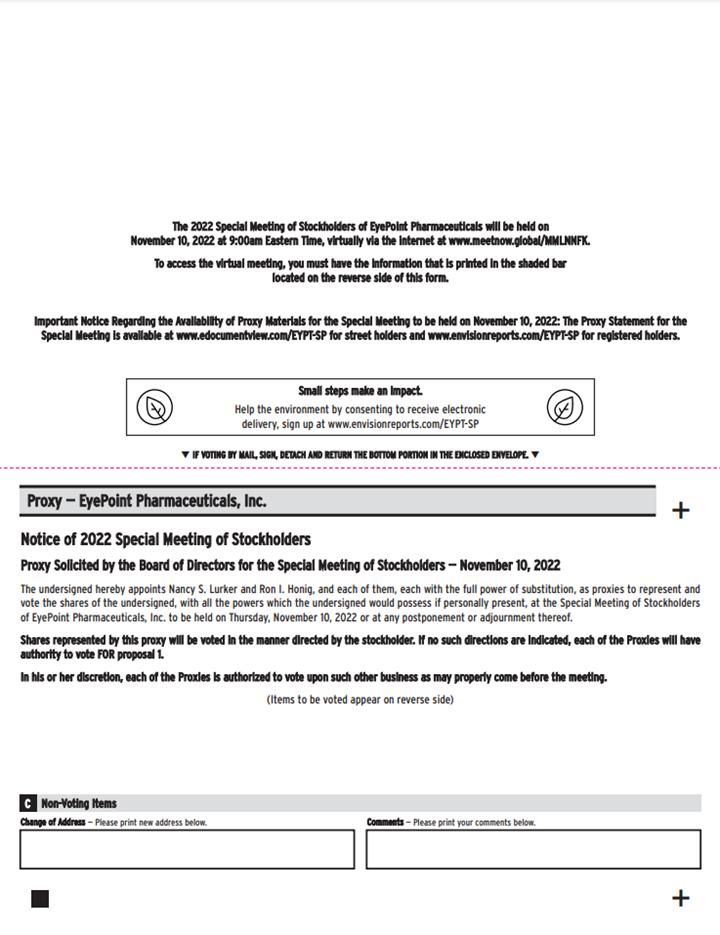

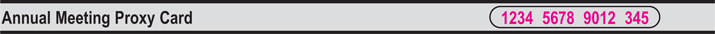

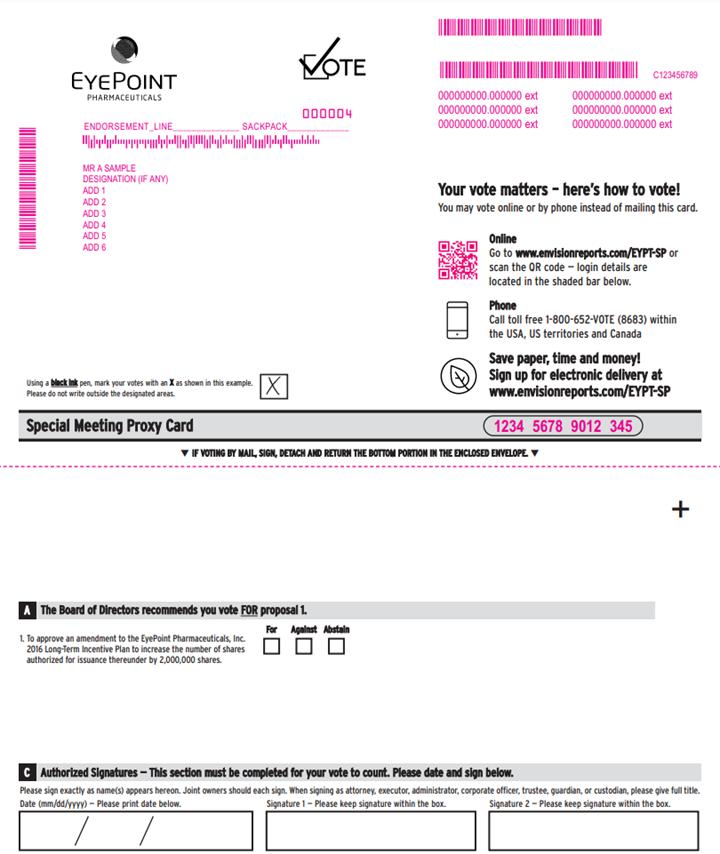

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 15, 2017NOVEMBER 10, 2022

Dear Stockholders:

NOTICE IS HEREBY GIVEN that the Annuala Special Meeting of Stockholders (the “Annual“Special Meeting”), of pSivida Corp.EyePoint Pharmaceuticals, Inc. (the “Company”), will be held on Friday, December 15, 2017,November 10, 2022 at 9:00 A.M. U.S.a.m., Eastern Standard Time, atTime. The Special Meeting will be a virtual meeting via live webcast on the Company’s Corporate Headquarters, 480 Pleasant Street, Watertown, Massachusetts 02472,Internet. You will not be able to attend the Special Meeting in person. Instead,you will be able to attend the Special Meeting by visiting http://www.meetnow.global/MMLNNFK.

The Special Meeting will be held for the following purposes:

| 1. | To elect seven directors to the Company’s board of directors. |

| 2. | For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 7.4 and for all other purposes, to ratify the issuance of 5,900,000 shares of Company common stock, par value US$0.001 per share (the “Common Stock”) between July 24, 2017 and November 7, 2017 on the terms and conditions disclosed in the accompanying proxy statement to refresh the Company’s capacity to issue shares of Common Stock without prior stockholder approval pursuant to ASX Listing Rule 7.1. |

| 3. | For the purposes of ASX Listing Rule 7.1A and for all other purposes, to approve the issuance of equity securities up to an additional 10% of the issued capital of the Company over a 12 month period, pursuant to ASX Listing Rule 7.1A, on the terms and conditions disclosed in the accompanying proxy statement. |

| 4. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 240,000 stock options, 120,000 restricted stock units and 115,000 performance stock units to Nancy Lurker on the terms disclosed in the accompanying proxy statement. |

| 5. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 17,500 deferred stock units to David J. Mazzo on the terms disclosed in the accompanying proxy statement. |

| 6. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to Michael W. Rogers on the terms disclosed in the accompanying proxy statement. |

| 7. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to Douglas Godshall on the terms disclosed in the accompanying proxy statement. |

| 8. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to James Barry on the terms disclosed in the accompanying proxy statement. |

| 9. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to Jay Duker on the terms disclosed in the accompanying proxy statement. |

| 10. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 40,000 stock options to Kristine Peterson on the terms disclosed in the accompanying proxy statement. |

| 11. | To approve, on an advisory basis, the Company’s executive compensation as disclosed in the accompanying proxy statement. |

| 12. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2018. |

| 13. | To transact such other business as may properly come before the meeting or any adjournment or postponement of the Annual Meeting. |

Thepurpose of approving an amendment to the EyePoint Pharmaceuticals, Inc. Amended and Restated 2016 Long-Term Incentive Plan, as amended, to increase the number of shares authorized for issuance thereunder by 2,000,000 shares (the “Plan Amendment Proposal”).The Company’s Board of Directors unanimously recommends that stockholders voteFOR ALL on Proposal No. 1 andFOR Proposal Nos. 2 through 12, except for Nancy Lurker (with respect the Plan Amendment Proposal. During the ten days before the Special Meeting, you may inspect a list of stockholders eligible to Proposal No. 4 only), David J. Mazzo (with respectvote. If you would like to Proposal No. 5 only), Michael W. Rogers (with respectinspect the list, please call John Mercer, our Director of IP and Corporate Counsel, at (508) 934-6243 to Proposal No. 6 only), Douglas Godshall (with respect to Proposal No. 7 only), James Barry (with respect to Proposal No. 8 only), Jay Duker (with respect to Proposal No. 9 only), and Kristine Peterson (with respect to Proposal No. 10 only), each of whom abstains from making a recommendation with respect toarrange the specified Proposal due to his or her interest in that Proposal.inspection.

Stockholders of record and holders of record of CHESS Depositary Interest (“CDIs”) at the close of business on November 10, 2017 (U.S. Eastern Standard Time),September 23, 2022, the record date of the AnnualSpecial Meeting, are entitled to notice of, and to vote at, the AnnualSpecial Meeting and any adjournment or postponement of the meeting. A list of stockholders as of the record date will be available for stockholder inspection at the Annual Meeting and at the Company’s executive offices at 480 Pleasant Street, Watertown, Massachusetts 02472 during normal business hours from November 10, 2017 to the date of the AnnualSpecial Meeting. CDI holders may instruct CHESS Depositary Nominees Pty Limited, the record holder of the Common Stock underlying the CDIs, to vote on their behalf in accordance with the voting procedures set forth in the accompanying proxy statement and the CDI voting instruction form.

The accompanying proxy statement includes further details with respect to the proposalsproposal to be considered at the AnnualSpecial Meeting. This notice of AnnualSpecial Meeting and the accompanying proxy statement contain important information and should be read in their entirety. If you are in doubt as to how you should vote at the AnnualSpecial Meeting, you should seek advice from your legal counsel, accountant or other professional adviser prior to voting.

| |

| By Order of the Board of Directors |

John D. Mercer

|

|

| Ron Honig |

| Chief Legal Officer and Company Secretary November 13, 2017

|

September 28, 2022

Watertown, Massachusetts

ii

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 15, 2017

Our Board of Directors (the “Board”) is soliciting your proxy for use at the annual meeting of stockholders (the “Annual Meeting”), to be held on Friday, December 15, 2017, at 9:00 A.M. U.S. Eastern Standard Time at our Corporate Headquarters, 480 Pleasant Street, Watertown, Massachusetts 02472, or any adjournment or postponement thereof, for the purposes set forth in the accompanying notice and this proxy statement. This proxy statement relates to the solicitation of proxies by the Board for use at the Annual Meeting.

In this proxy statement, the words “pSivida,” “the Company,” “we,” “our,” “ours,” “us” and similar terms refer to pSivida Corp., unless the context indicates otherwise.

On or about November 15, 2017, we began sending this proxy statement, the attached Notice of Annual Meeting of Stockholders, proxy card, CDI Voting Instruction Form and Annual Report, which includes our financial statements for the fiscal year ended June 30, 2017 (“Annual Report”), to all stockholders entitled to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON DECEMBER 15, 2017: We are delivering to all stockholders paper copies of all proxy materials. In addition, a complete set of proxy materials relating to the Annual Meeting is available on the Internet. These materials, consisting of the notice of Annual Meeting, this proxy statement, the Annual Report for our fiscal year ended June 30, 2017, proxy card and CDI voting instruction form, are available on the following websites:www.edocumentview.com/PSDV for street holders andwww.envisionreports.com/PSDV for registered holders.

SOLICITATION AND VOTING

Voting Rights and Procedures

Only those stockholders of record and holders of record of CHESS Depositary Interests (“CDIs”) as of the close of business on November 10, 2017 (U.S. Eastern Standard Time), the record date, will be entitled to vote at the Annual Meeting and any adjournment or postponement thereof. Those persons holding CDIs are entitled to receive notice of and attend the Annual Meeting and may instruct CHESS Depositary Nominees Pty Limited (“CDN”) to vote at the meeting by following the instructions on the CDI voting instruction form.

As of the record date, we had 45,256,999 shares of our common stock, par value US$0.001 per share (the “Common Stock”), outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder as of the close of business on the record date is entitled to one vote for each share of Common Stock held by such stockholder. Each CDI holder as of the close of business on the record date is entitled to direct CDN, the record holder of the Common Stock underlying our CDIs, to vote one share for every CDI held by such holder.

BrokerNon-Votes

If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker with voting instructions, your shares may constitute “brokernon-votes.” Brokernon-votes occur on a

matter when the broker is not permitted under applicable stock exchange rules to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as“non-routine” matters.

At the Annual Meeting, Proposal Nos. 1 through 11 are considered“non-routine” matters while Proposal No. 12 is considered a “routine” matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, your shares will not be voted on Proposal Nos. 1 through 11 and a brokernon-vote will occur on these matters. In tabulating the voting result for any particular proposal, shares that constitute brokernon-votes are not considered voting power present with respect to that proposal. Thus, brokernon-votes will not affect the outcome of Proposal Nos. 1 through 11, assuming that a quorum is obtained.

Quorum

A “quorum” is necessary to conduct business at the Annual Meeting.One-third of the outstanding shares of our Common Stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Abstentions and brokernon-votes will be counted as present for purposes of determining a quorum at the Annual Meeting. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

Voting Requirements

| • | | Proposal No. 1: Elect seven directors to the Board.Votes may be cast:FOR ALL nominees,WITHHOLD ALL nominees orFOR ALL EXCEPT those nominees noted by you on the appropriate portion of your proxy or voting instructions. A plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting is required to elect director nominees, and as such, the seven nominees who receive the greatest number of votes of the shares present in person or presented by proxy at the Annual Meeting will be elected. Brokernon-votes and abstentions will have no effect on the outcome of this proposal. |

| • | | Proposal No. 2: Ratify the issuance of 5,900,000 shares of Common Stock between July 24, 2017 and November 7, 2017 pursuant to Australian Securities Exchange (“ASX”) Listing Rule 7.4 on the terms and conditions disclosed in this proxy statement to refresh our capacity to issue shares of Common Stock without prior stockholder approval pursuant to ASX Listing Rule 7.1. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 2 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 3: Approve the issuance of equity securities up to an additional 10% of our issued capital over a 12 month period, pursuant to ASX Listing Rule 7.1A, on the terms and conditions disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 3 requires the affirmative vote of at least 75% of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 4: Approve the grant of stock options, restricted stock units and performance stock units to Nancy Lurker on the terms disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 4 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal Nos.5-9: Approve the annual grants of stock options and deferred stock units to each of David J. Mazzo, Michael W. Rogers, Douglas Godshall, James Barry and Jay Duker on the terms disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval

|

| of Proposal Nos. 5 through 9 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal.

|

| • | | Proposal No. 10: Approve the initial grant of stock options to Kristine Peterson on the terms disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 10 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 11: Approve, on an advisory basis, our executive compensation as disclosed in this proxy statement.Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 11 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 12: Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 12 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will not occur in connection with this proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on the ratification of independent registered public accounting firms under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions will have the effect of anAGAINST vote on this proposal. |

Proxy Solicitation

We will bear the cost of preparing, assembling, printing, mailing, and distributing these proxy materials. If you choose to vote over the Internet, you are responsible for Internet access charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We have retained The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and to provide related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed US$15,000. In addition to soliciting stockholders through our employees, we will request banks, brokers and other intermediaries holding shares of our Common Stock beneficially owned by others to solicit the beneficial owners and will reimburse them for their reasonable expenses in doing so.

VOTING INSTRUCTIONS

Voting Process for Stockholders

All shares of our Common Stock represented by a properly executed proxy received before the time indicated on the proxy will, unless the proxy is revoked, be voted in accordance with the instructions indicated on the proxy. If no instructions are indicated on the proxy, the shares will be voted as the proxy holder nominated on the proxy card determines, or, if no person is nominated, the shares will be voted “FOR ALL” on Proposal No. 1 and “FOR”on Proposal Nos. 2 through 12 in accordance with the Board’s recommendations on each proposal. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment.

Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to vote in person, please bring proof of identification. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will

be counted if you later decide not to attend the Annual Meeting. Shares held in street name through a brokerage account or by a bank or other nominee may be voted in person by you if you obtain a valid proxy from the record holder giving you the right to vote the shares. CDI holders may attend the meeting, but cannot vote in person at the meeting.

Stockholders may submit a proxy in any of the following three ways:

By Internet: You may submit a proxy by Internet 24 hours a day through 1:00 a.m., December 15, 2017 (U.S. Eastern Standard Time) by following the instructions that are included on your enclosed proxy card. If you submit a proxy by Internet, you do not need to return your proxy card.

By Telephone: You may submit a proxy by telephone 24 hours a day through 1:00 a.m., December 15, 2017 (U.S. Eastern Standard Time) by following the instructions that are included on your enclosed proxy card. If you submit a proxy by telephone, you do not need to return your proxy card.

By Mail: You may submit a proxy by signing and returning the enclosed proxy card as indicated.

You may revoke your proxy at any time before it is voted by properly executing and delivering a later-dated proxy card, by later submitting a proxy by Internet or telephone, by delivering a written revocation to our Secretary or by attending the Annual Meeting, requesting a return of your proxy and voting in person.

Although we encourage stockholders to submit a proxy by Internet, telephone or mail, whether or not they attend the Annual Meeting, stockholders also may vote by attending, and voting in person at, the Annual Meeting.

Voting Process for CDI Holders

CDI holders may cause the shares of common stock underlying their CDIs to be voted only by their written instructions to CDN. CDI holders should complete, sign and return the CDI Voting Instruction Form.

Computershare will collect and process voting instructions from CDI holders. Computershare must receive the CDI Voting Instruction Form, completed and returned in accordance with the instructions provided on the form, by no later than 1:00 p.m. December 12, 2017 Australian Western Standard Time (AWST).

A CDI holder may revoke a CDI Voting Instruction Form by delivering to Computershare, no later than 1:00 p.m. December 12, 2017 (AWST), a new CDI Voting Instruction Form or a written notice of revocation, in either case bearing a later date than the CDI Voting Instruction Form previously sent.

CDI holders may attend the Annual Meeting, but cannot vote in person at the Annual Meeting.

PROPOSAL 1

ELECTION OF SEVEN DIRECTORS

The Board currently consists of seven directors, David J. Mazzo, Nancy Lurker, Michael W. Rogers, Douglas Godshall, James Barry, Jay Duker and Kristine Peterson. Each of these directors has been nominated by the Board for election at the Annual Meeting. Each nominee, if elected, will hold office until our 2018 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified, or until he or she sooner dies, resigns or is removed. The proposed nominees are not being nominated pursuant to any arrangement or understanding with any person. We do not anticipate that any nominee will become unavailable to serve.

Biographical information and the attributes, skills and experience of each nominee that led our Governance and Nominating Committee and Board to determine that such nominee should serve as a director are discussed in the “Directors and Executive Officers” section of this proxy statement.

THE BOARD RECOMMENDS THAT YOU VOTE FOR ALL ON PROPOSAL NO. 1 TO ELECT DAVID J. MAZZO, NANCY LURKER, MICHAEL W. ROGERS, DOUGLAS GODSHALL, JAMES BARRY, JAY DUKER AND KRISTINE PETERSON TO THE BOARD.

DIRECTORS AND EXECUTIVE OFFICERS

Directors

Our Board of Directors, or the Board, consists of seven (7) members. The term of each director expires each year at our Annual Meeting of Stockholders. Each director also continues to serve as a director until his or her successor is duly elected and qualified, or until he or she sooner dies, resigns, or is removed. The following table sets forth the name, age, director service period and position of each of our current directors, as of November 10, 2017:

| | | | | | | | |

Name | | Age | | | Position | | Director Since |

David Mazzo | | | 60 | | | Chairman of the Board of Directors | | 2005 |

Nancy Lurker | | | 59 | | | President and Chief Executive Officer and Director | | 2016 |

Michael Rogers | | | 57 | | | Director | | 2005 |

Douglas Godshall | | | 53 | | | Director | | 2012 |

James Barry | | | 58 | | | Director | | 2014 |

Jay Duker | | | 59 | | | Director | | 2016 |

Kristine Peterson | | | 58 | | | Director | | 2017 |

Set forth below for each current director is a list of Board Committee memberships and a description of his or her business experience, qualifications, education and skills that led our Board to conclude that such individual should serve as a member of our Board:

David J. Mazzo, Ph.D.

Chairman of the Board, Chairman of the Compensation Committee and member of the Governance and Nominating Committee and the Science Committee

Dr. Mazzo has been the Chief Executive Officer and a director of Caladrius Biosciences, Inc., a Nasdaq Stock Market LLC, or NASDAQ, listed company, since January 2015. Caladrius is a clinical stage development company with a pipeline of cell therapy product candidates in autoimmune disease (type I diabetes) and select cardiovascular indications. Prior to joining Caladrius, Dr. Mazzo served from August 2008 to October 2014 as Chief Executive Officer and as a member of the board of directors of Regado Biosciences, Inc., a NASDAQ-listed biopharmaceutical company focused on the development of novel antithrombotic drug systems for acuteand sub-acute cardiovascular indications. Prior to his leading Regado, from March 2007 to April 2008, Dr. Mazzo was President, Chief Executive Officer and a director of Æterna Zentaris, Inc., a publicly held international biopharmaceutical company. From 2003 until 2007, Dr. Mazzo served as President, Chief Executive Officer and a director of Chugai Pharma USA, LLC, a biopharmaceutical company which was the U.S. subsidiary of Chugai Pharmaceutical Co., Ltd. of Japan. Dr. Mazzo has also held senior management and executive positions in research and development and/or directorships with the Essex Chimie European subsidiary at Schering-Plough Corporation, a publicly held pharmaceutical company that was subsequently acquired by Merck & Co., Inc.; Hoechst Marion Roussel, Inc., the U.S. subsidiary of Hoechst AG, which was subsequently acquired by Sanofi, a multinational pharmaceuticals company; and Rhone-Poulenc Rorer, Inc., a subsidiary of Rhone-Poulene SA, a French pharmaceuticals company, which was subsequently acquired by Hoechst AG. He also previously served on the board of directors of Avanir Pharmaceuticals, Inc., a specialty pharmaceutical company, from 2005 until Avanir was sold to Otsuka Holdings in 2015. Dr. Mazzo earned a B.A. in the Honors Program (Interdisciplinary Humanities) and a B.S. in Chemistry from Villanova University. In addition, Dr. Mazzo received his M.S. in chemistry and his Ph.D. degree in analytical chemistry from the University of Massachusetts, Amherst. He was also a research fellow at the Ecole Polytechnique Federale de Lausanne, Switzerland. We believe Dr. Mazzo is qualified to serve on our Board because his extensive experience as an executive officer and director in the life sciences industry, his understanding of the strategic and regulatory

environment in which we conduct our business, his lengthy track record in global product development, his Ph.D. in analytical chemistry and his broad scientific and managerial background provide him expertise in the oversight of companies in this sector and the ability to guide such companies through varying operating climates.

Nancy Lurker

President and Chief Executive Officer

Ms. Lurker has been our President and Chief Executive Officer since September 2016. From 2008 to 2015, Ms. Lurker served as President and Chief Executive Officer and a director of PDI, Inc., a NASDAQ-listed healthcare commercialization company now named Interpace Diagnostics Group, Inc. From 2006 to 2007, Ms. Lurker was Senior Vice President and Chief Marketing Officer of Novartis Pharmaceuticals Corporation, the U.S. subsidiary of Novartis AG. From 2003 to 2006, she served as President and Chief Executive Officer of ImpactRx, Inc., a privately held healthcare information company. From 1998 to 2003, Ms. Lurker served as Group Vice President, Global Primary Care Products and Vice President, General Therapeutics for Pharmacia Corporation (Pharmacia), now a part of Pfizer, Inc. She also served as a member of Pharmacia’s U.S. executive management committee. Previously, Ms. Lurker spent 14 years at Bristol-Myers Squibb Company, rising from a sales representative to Senior Director, Worldwide Cardiovascular Franchise Management. Ms. Lurker serves as chair of the board of directors of X4 Pharmaceuticals, Inc. and as a member of the board of directors of the Cancer Treatment Centers of America, both privately held companies. Ms. Lurker previously served as a member of the boards of directors of publicly held Auxilium Pharmaceuticals, Inc. from 2011 to 2015 and Mallinckrodt Pharmaceuticals, plc from 2013 to 2016, in addition to serving as a director of PDI, Inc. from 2008 to 2015. Ms. Lurker received a B.S. in Biology from Seattle Pacific University and an M.B.A. from the University of Evansville. We believe Ms. Lurker is qualified to serve on our Board because of her role as our President and Chief Executive Officer, as well as her broad ranging experience in the pharmaceutical industry and her track record of maximizing the potential of new therapies and successfully implementing innovative U.S. and global drug launches, which provide her with valuable expertise and perspective on our corporate strategy, management, operations and governance.

Michael Rogers

Chairman of the Audit and Compliance Committee and member of the Compensation Committee

Mr. Rogers served as the Chief Financial Officer of Acorda Therapeutics, Inc., a biotechnology company focused on neurological disorders, from October 2013 until October 2016. From June 2009 to October 2012, Mr. Rogers served as Executive Vice President and Chief Financial Officer of BG Medicine, Inc., a company focused on the development of novel biomarker-based diagnostics. Mr. Rogers was Executive Vice President, Chief Financial Officer and Treasurer of Indevus Pharmaceuticals Inc., a specialty pharmaceutical company, from February 1999 until April 2009. Mr. Rogers was previously Executive Vice President and Chief Financial and Corporate Development Officer at Advanced Health Corporation, a health care information technology company, Vice President, Chief Financial Officer and Treasurer of AutoImmune, Inc., a biopharmaceutical company, and Vice President, Investment Banking at Lehman Brothers, Inc. and at PaineWebber, Inc. Mr. Rogers is the chairman of the board of directors of Keryx Biopharmaceuticals, Inc., a biopharmaceutical company focused on bringing innovative medicines to people with renal disease. Mr. Rogers was previously a director of Coronado Biosciences, Inc. We believe Mr. Rogers is qualified to serve on our Board because of his significant experience as CFO of various companies and as an investment banker have provided him with expertise in strategic transactions, corporate operations, financial management, taxes, accounting, controls, finance and financial reporting in the life sciences industry as well as valuable insight into the strategy of our company.

Douglas Godshall

Chairman of the Governance and Nominating Committee and member of the Compensation Committee

Mr. Godshall serves as President and Chief Executive Officer at Shockwave Medical, a privately held company which is creating and commercializing interventional devices designed to better address patients with

problematic cardiovascular calcification. Previously, he served as the Chief Executive Officer of HeartWare International, Inc., a NASDAQ-listed company, and its predecessor HeartWare Limited, a medical device company focused on heart failure, from September 2006 until August 2016 and as director from October 2006 until August 2016. HeartWare was acquired by Medtronic PLC in August 2016. Prior to joining HeartWare Limited, Mr. Godshall served in various executive and managerial positions at Boston Scientific Corporation, where he had been employed since 1990, including as a member of Boston Scientific’s Operating Committee. From January 2005 he served as President, Vascular Surgery, and for the prior five years as Vice President, Business Development, focused on acquisition strategies for the cardiology, electrophysiology, neuroradiology and vascular surgery divisions. Mr. Godshall has a Bachelor of Arts in Business from Lafayette College and Masters of Business Administration from Northeastern University. Mr. Godshall has served on the board of directors of Vital Therapies, Inc., a public company traded on NASDAQ that develops cell-based therapies for the treatment of liver disease, since May 2013, and the board of directors of the Medical Device Manufacturers Association, a national trade association, since May 2014. We believe Mr. Godshall is qualified to serve on our Board because his managerial experience at public, life sciences companies provides him insights as a successful life sciences entrepreneurwith in-depth knowledge of medical product strategy and development.

James Barry, Ph.D.

Member of the Audit and Compliance Committee and the Science Committee

Dr. Barry has been the President and Chief Executive Officer of InspireMD, a global medical device company focused on the development and commercialization of vascular products, since June 2016 and has served on the board of directors of Inspired MD since January 2011. Prior to this, he served as the Executive Vice President and Chief Operating Officer of InspireMD. Prior to joining InspireMD, Dr. Barry served as Executive Vice President and Chief Operating Officer of Arsenal Medical from August 2011 until September 2012, and as President and CEO and Director from September 2012 until December 2013. Dr. Barry has been the Principal Founder at Convergent Biomedical Group since September 2010. Dr. Barry served in various executive and managerial positions at Boston Scientific Corporation, where he had been employed from 1992 until 2010, including as a member of Boston Scientific’s Operating Committee. From 2007 through 2010 he served as Senior Vice President, Corporate Technology Development, responsible for the global research and development function, and for the prior six years he served as Vice President, Corporate Research and Advanced Technology Development. Dr. Barry is also a director of AgNovos Healthcare LLC and Cardiac Implants and in the past also served as a director of MicroChips Corporation. Dr. Barry has a Bachelor of Arts in Chemistry from St. Anselm College and a Ph.D. in Biochemistry from the University of Massachusetts. We believe Dr. Barry is qualified to serve on our Board because his significant experience developing products, leading research and development teams and building successful businesses, coupled with his expertise in advising clients in the pharmaceutical, biotechnology and medical device industries, brings valuable technical expertise and commercial experience to our company.

Jay Duker, M.D.

Chairman of the Science Committee and member of the Governance and Nominating Committee

Dr. Duker is the Director of the New England Eye Center, where he has served in various capacities since 1992. He is also Professor and Chairman of Ophthalmology at Tufts Medical Center and Tufts University School of Medicine. He has published more than 200 journal articles related to ophthalmology andis co-author of Yanoff and Duker’s Ophthalmology, a best-selling ophthalmic text. Dr. Dukeris co-founder of three companies, including Hemera Biosciences, Inc., a privately held company seeking to develop anti-compliment gene-based therapies for the treatment of dry andwet age-related macular degeneration. Dr. Duker serves as a director of Hemera and Eleven Biotherapeutics, a publicly held biopharmaceutical company advancing a broad pipeline of novel anti-cancer agents based on its Targeted Protein Therapeutics. Dr. Duker received an A.B. from Harvard University and an M.D. from the Jefferson Medical College of Thomas Jefferson University. We believe Dr. Duker is qualified to serve on our Board because his extensive clinical and academic experience and

expertise in ophthalmology coupled with his leadershipas co-founder of other life sciences companies provide him with valuable clinical, scientific and commercial insight to bring to our company.

Kristine Peterson

Member of the Audit and Compliance Committee and the Governance and Nominating Committee

Ms. Peterson has over 30 years of healthcare industry experience. She most recently served from 2009 to 2016 as Chief Executive Officer of Valeritas, Inc., a medical technology company focused on innovative drug delivery systems, and as a strategic advisor to Valeritas until August 2017. Prior to that, Ms. Peterson served as Company Group Chair of Johnson & Johnson’s biotech groups from 2006 to 2009, and as Executive Vice President of Johnson & Johnson’s global strategic marketing organization from 2004 to 2006. Prior to that, she served as Senior Vice President, Commercial Operations for Biovail Corporation, a pharmaceutical company, and President of Biovail Pharmaceuticals from 2003 to 2004. Ms. Peterson began her career at Bristol-Myers Squibb, holding assignments of increasing responsibility spanning marketing, sales and general management, including running a cardiovascular / metabolic business unit and a generics division. Ms. Peterson is also a director of Paratek Pharmaceuticals, Inc., Immunogen, Inc. and Amarin Corporation plc, and within the past five years also served as a director of Valeritas, Inc. Ms. Peterson earned a B.S. and M.B.A. from the University of Illinois at Champaign Urbana. We believe Ms. Peterson is qualified to serve on our Board because of her extensive executive management and sales and marketing experience in both large, multinational pharmaceutical and smaller biotechnology companies, in particular as it relates to later-stage development and commercialization, as well as her other public company board experience.

Executive Officers

Each of our executive officers holds office until the first meeting of our Board following the next annual meeting of stockholders and until such officer’s respective successor is chosen and qualified, unless a shorter period shall have been specified by the terms of such officer’s election or appointment. The following table sets forth information about our executive officers:

| | | | | | |

Name

| | Age | | | Position

|

Nancy Lurker

| | | 59 | | | President and Chief Executive Officer |

Deb Jorn

| | | 59 | | | Executive Vice President, Corporate and Commercial Development |

Dario Paggiarino

| | | 60 | | | Vice President, Chief Medical Officer |

Leonard S. Ross

| | | 67 | | | Vice President, Finance and Chief Accounting Officer and Principal Financial Officer |

Nancy Lurker

Please refer to the section entitled “Directors, Executive Officers and Corporate Governance—Directors” above for Ms. Lurker’s biographical information.

Deb Jorn

Ms. Jorn has served as our Executive Vice President of Corporate and Commercial Development since November 2016. From 2013 to 2016, Ms. Jorn was EVP and Company Chair at Valeant Pharmaceuticals, and previously served from 2010 to 2013 as Chief Marketing Officer at Bausch & Lomb. From 2004 to 2010, Ms. Jorn was Group VP of Women’s Healthcare and Fertility at Schering Plough. From 2002 to 2004, she served as the Worldwide VP of Internal Medicine and Early Commercial Input at Johnson & Johnson. She began her career at Merck and for more than twenty years held roles of progressive responsibility in a variety of functions

including R&D, regulatory, sales, and marketing. Ms. Jorn is a member of the Board of Directors for Orexigen Therapeutics, Inc. and Viveve, Inc. Ms. Jorn holds a B.A. in Biochemistry from Rutgers University and an MBA from New York University’s Stern Graduate School of Business Administration.

Dario Paggiarino

Dr. Paggiarino has served as our Vice President, Chief Medical Officer since August 2016. Prior to that, Dr. Paggiarino served since April 2013 as Senior Vice President and Chief Development Officer of Lpath, Inc., a biotechnology company focused on the discovery and development of lipidomic-based therapeutic antibodies that target bioactive signaling lipids to treat a wide range of human diseases. Dr. Paggiarino served as Vice President and Therapeutic Unit Head for retina diseases at Alcon, a division of Novartis from 2011 to 2013. He served as Executive Director of Clinical Development and Medical Affairs at Pfizer Global R&D, a division of Pfizer, Inc., from 2001 to 2011. Earlier in his career, he held research and development positions of increasing responsibility at Angelini Pharmaceuticals, Inc., an affiliate of Angelini S.p.A, a privately-owned company, ultimately serving as president and later joined Pharmacia Global R&D, a division of Pharmacia Corporation, where he was clinical program director of ophthalmology.

Leonard S. Ross

Mr. Ross has served as our Vice President, Finance and Chief Accounting Officer since July 2017, and was previously Vice President, Finance since November 2009 and before that our Corporate Controller from October 2006. Mr. Ross was designated as our principal financial officer in March 2009. From 2001 through April 2006, Mr. Ross served as Corporate Controller for NMT Medical, Inc., a medical device company. From 1990 to 1999, Mr. Ross was employed by JetForm Corporation, a developer of workflow software solutions, where he served in various capacities, including Vice President, Finance and Vice President, International Operations. Mr. Ross received a B.S. in Chemical Engineering from Tufts University, an M.B.A. from the Amos Tuck School at Dartmouth College and an M.S. in Taxation from Bentley College.

Family Relationships

There are no family relationships among any of our directors or executive officers.

Arrangements between Officers and Directors

There is no arrangement or understanding between any of our executive officers or directors and any other person, pursuant to which such person was selected to serve as an executive officer or director, as applicable.

Board Committees

The Board has four standing committees: the Audit and Compliance Committee, the Compensation Committee, the Governance and Nominating Committee and the Science Committee. Each standing committee has a written charter. Each of the Audit and Compliance Committee, the Compensation Committee and the Governance and Nominating Committee is comprised entirely of independent directors. The Science Committee is currently comprised entirely of independent directors, but may in the future include members of our R&D organization and other members of executive management in accordance with its charter. While each committee has designated responsibilities, the committees act on behalf of the entire Board and regularly report on their activities to the entire Board. Details concerning the role and structure of the Board and each Board committee are contained in the Corporate Governance Guidelines and the committee charters, available on the “Investor” section of our website at www.psivida.com under “Corporate Governance.”

Audit and Compliance Committee

The Audit and Compliance Committee is responsible for assisting the Board with oversight of our accounting and financial reporting processes, including but not limited to (i) our audit program; (ii) the integrity

of our financial statements; (iii) the review and assessment of the qualifications and independence of our independent registered public accounting firm and (iv) the preparation of reports required of the Audit and Compliance Committee under the rules of the SEC. More specifically, the Audit and Compliance Committee’s responsibilities include:

appointing, overseeing and, if necessary, replacing the independent registered public accounting firm, including evaluating the effectiveness and independence of the firm at least annually, approvingor pre-approving all auditand non-audit services provided by the firm and establishing hiring policies for employees or former employees of the firm, and also including resolving any disagreements between management and the firm regarding financial reporting;

reviewing with the independent registered public accounting firm the scope of, plans for and any difficulties with audits and the adequacy of staffing and compensation;

reviewing with the independent registered public accounting firm matters required to be communicated to audit committees in accordance with Public Company Accounting Oversight Board, or PCAOB, Auditing Standard No. 1301 Communications With Audit Committees;

reviewing with management and the independent registered public accounting firm our internal controls, financial and critical accounting policies (including effects of alternate United States generally accepted accounting principles, or GAAP, methodsand off-balance sheet structures, if any), risk assessment and management policies;

reviewing with management and the independent registered public accounting firm our annual and quarterly financial statements and financial disclosure, and preparing the Audit and Compliance Committee report for inclusion in our annual proxy statement;

reviewing, or establishing standards for, the substance and presentation of information included in earnings press releases and other earnings guidance;

reviewing material pending legal proceedings and other contingent liabilities;

implementing appropriate control processes for accounting, disclosures and reporting, review and approval of intercompany, related party and significant unusual transactions;

establishing procedures for receipt, retention and treatment of complaints, including the confidential and anonymous submission of concerns by employees regarding accounting, internal accounting controls or auditing matters;

receiving from management a report of any significant deficiencies and material weaknesses in the design or operation of our internal controls, and any fraud involving management or other employees who have a significant role in our internal controls;

presenting to the Board annually an evaluation of the Audit and Compliance Committee’s performance and charter; and

performing such other activities as the Board or the Audit and Compliance Committee deem appropriate.

The members of the Audit and Compliance Committee are Mr. Rogers (chair), Dr. Barry and Ms. Peterson. Each of Mr. Rogers, Dr. Barry and Mr. Godshall was a member of the Audit and Compliance Committee for the entirety of fiscal 2017. Ms. Peterson has served on the committee since July 1, 2017, replacing Mr. Godshall.

The Board has determined that all current and fiscal 2017 members of the Audit and Compliance Committee are independent for purposes of service on the Audit and Compliance Committee as provided in SEC, NASDAQ and Australian Securities Exchange (ASX) rules, as applicable. The Board also has determined that Mr. Rogers and Ms. Peterson are audit committee financial experts.

The Audit and Compliance Committee met five times during the fiscal year ended June 30, 2017.

Compensation Committee

The Compensation Committee is responsible for (i) discharging the Board’s responsibilities relating to executive compensation, (ii) overseeing our compensation and employee benefits plans and practices, including incentive, equity-based and other compensatory plans in which executive officers and key employees participate and (iii) producing a report on executive compensation as required by the SEC. More specifically, the Compensation Committee’s responsibilities include:

developing and periodically reviewing compensation policies and practices applicable to executive officers;

determining and approving the compensation of the CEO and other executive officers;

supervising, administering and evaluating incentive, equity-based and other compensatory plans of our company in which executive officers and key employees participate, including approving guidelines and size of grants and awards, making grants and awards, interpreting and promulgating rules relating to the plans, modifying or canceling grants or awards, designating employees eligible to participate and imposing limitations and conditions on grants or awards;

reviewing and approving, subject to stockholder approval as required by any applicable law, regulation or NASDAQ rule, the creation or amendment of any incentive, equity-based and other compensatory plans of our company in which executive officers and key employees participate (other than amendmentsto tax-qualified employee benefit plans and trusts, and any supplemental plans thereunder, that do not substantially alter the costs of such plans to our company or are to conform such plans to applicable laws or regulations) and all related policies and programs;

reviewing and approving any employment agreements, severance arrangements,change-in-control arrangements or special or supplemental employee benefits, and any material amendments to any of the foregoing, applicable to executive officers and other employees of our company;

making individual determinations and granting any shares, stock options or other equity-based awards under all equity-based compensation plans that are outside approved guidelines for such grants, and exercising such power and authority as may be required or permitted under such plans;

annually evaluating the performance of the Compensation Committee;

annually reviewing and reassessing the charter of the Compensation Committee and, if appropriate, recommending changes to the Board;

annually evaluating the adequacy of directors’ compensation and the composition of such compensation;

reviewing the Compensation Discussion & Analysis to be included in our annual proxy statement or Annual Report onForm 10-K and issuing a Compensation Committee report thereon as required by the SEC to be included in our annual proxy statement or Annual Report onForm 10-K filed with the SEC;

reviewing significant risks or exposures facing us and discussing the relationship, if any, between these risks and our compensation policies and practices, as well as appropriate means through compensation policy to mitigate these risks;

performing such other duties and responsibilities as may be assigned to the Compensation Committee by the Board or as designated in plan documents; and

forming and delegating authority to subcommittees, comprised of one or more members of the Compensation Committee, when the Compensation Committee deems appropriate.

The members of the Compensation Committee are Dr. Mazzo (chair), Mr. Rogers and Mr. Godshall, each of whom was a member of the Compensation Committee for the entirety of fiscal 2017.

The Compensation Committee met seven times during the fiscal year ended June 30, 2017.

Governance and Nominating Committee

The Governance and Nominating Committee is responsible for (i) identifying and recommending to the Board individuals qualified to serve as directors, (ii) advising the Board with respect to the Board composition and procedures, (iii) overseeing the evaluation of the Board and (iv) developing and maintaining our corporate governance policies. The Governance and Nominating Committee has periodically engaged third parties to identify and evaluate candidates qualified to serve as our directors and may continue to do so in the future. More specifically, the Governance and Nominating Committee’s responsibilities include:

identifying, recruiting and interviewing candidates for Board membership;

reviewing the background and qualifications of individuals being considered as director candidates;

developing and recommending to the Board guidelines and criteria to determine the qualifications of directors;

recommending to the Board the director nominees for election by the stockholders or appointment by the Board to fill any vacancies pursuant to theour By-Laws;

reviewing and considering candidates for election submitted by stockholders;

reviewing the suitability for continued service as a director of each Board member when his or her term expires, and recommending whether or not the director shouldbe re-nominated;

monitoring the independence (within the meaning of the NASDAQ listing requirements) of Board members and the overall Board composition;

reviewing periodically the size of the Board and to recommend to the Board any appropriate changes;

making recommendations on the frequency and structure of Board meetings and on the practices of the Board;

recommending to the Board the directors to be appointed to each committee of the Board, including the Governance and Nominating Committee;

overseeing an annual self-evaluation of the Board and its committees to determine whether the Board and its committees are functioning effectively;

performing such other duties and responsibilities as may be assigned to the Governance and Nominating Committee by the Board or as designated in plan documents; and

forming and delegating authority to subcommittees, comprised of one or more members of the Governance and Nominating Committee, when the Governance and Nominating Committee deems appropriate.

The members of the Governance and Nominating Committee are Mr. Godshall (chair), Dr. Mazzo, Dr. Duker and Ms. Peterson. Each of Mr. Godshall, Dr. Mazzo and Mr. Rogers was a member of the Governance and Nominating Committee for the entirety of fiscal 2017, with Mr. Godshall replacing Dr. Mazzo as Committee Chair on January 17, 2017. Dr. Duker was appointed to the Governance and Nominating Committee on January 17, 2017. Ms. Peterson was appointed to the Governance and Nominating Committee on July 1, 2017, replacing Mr. Rogers.

The Governance and Nominating Committee met six times during the fiscal year ended June 30, 2017.

Science Committee

The Science Committee is responsible for reviewing the science, clinical and regulatory strategy underlying our research and development programs and making recommendations to the Board on key strategic and tactical

issues relating to our research and development activities. More specifically, the Science Committee’s responsibilities include:

reviewing the science and clinical and regulatory strategy underlying the major research and development programs, including publication strategies;

reviewing our significant medical affairs strategies and initiatives;

reviewing the annual research and development budget and allocation of resources to discovery and development programs;

reviewing the capacity and skill set of the research development organization;

reviewing the implications for the research and development organization of significant business development transactions, including mergers, acquisitions, licensing and collaborative agreements;

reviewing the progress toward achievement of key research and development milestones; and

reviewing the interactions of the research and development organization with health care providers and regulatory bodies, especially as with regard to reporting of adverse events and/or unexpected negative data observed in the preclinical and clinical studies conducted by us.

The members of the Science Committee are Dr. Duker (chair), Dr. Mazzo and Dr. Barry. Each of Dr. Mazzo and Dr. Barry was a member of the committee for the entirety of fiscal 2017. Dr. Duker was appointed to the Science Committee on January 17, 2017 as the Chair, replacing Mr. Godshall, who served as Chair of the committee during fiscal 2017 until January 16, 2017.

The Science Committee met one time during the fiscal year ended June 30, 2017.

Attendance at Board and Committee Meetings

The Board met 9 times during the fiscal year ended June 30, 2017. Each of the directors who served during fiscal 2017 standing for election attended at least 75% of the aggregate of the total number of meetings of the Board and of the committees on which he or she served. In accordance with our policy that encourages each director to attend Annual Meetings, all of the directors then in office at the time of our 2016 annual meeting of stockholders attended our 2016 annual meeting of stockholders.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee. None of the members of our Compensation Committee has ever been employed by us. For a description of transactions, if any, between us and members of our Compensation Committee and affiliates of such members, please see the section of this proxy statement entitled “Transactions with Related Persons.”

CORPORATE GOVERNANCE

Director Independence

The Board has unanimously determined that Dr. Mazzo, Mr. Rogers, Mr. Godshall, Dr. Barry, Dr. Duker and Ms. Peterson are independent under applicable standards of the SEC, NASDAQ and ASX. Our other director, Ms. Lurker, serves as our President and Chief Executive Officer. Each of the Audit Committee, the Compensation Committee, the Governance and Nominating Committee and the Science Committee is comprised entirely of independent directors.

Board Leadership Structure

The Board has chosen to separate the roles of Chairman and Chief Executive Officer and believes that such a separation of roles is in our best interests and the best interests of our stockholders. Dr. Mazzo’s tenure as a member of our Board, extensive experience in the biotechnology industry and perspective as an independent director provide effective leadership for our Board and support for our executive team. Ms. Lurker’s track record of maximizing the potential of new therapies and successfully implementing U.S. and international drug launches position her to lead us in the execution of our strategy and in the daily management of our business.

Board’s Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to the company. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to us. The Board administers its risk oversight role directly and through its committee structure. The Board reviews strategic and financial risks and exposures associated with our long-term strategy, development and commercialization of products and product candidates and other matters that may present material risk to our operations, strategy and prospects. The Audit and Compliance Committee reviews risks associated with financial and accounting matters, including financial reporting, accounting, disclosure and internal control over financial reporting. The Compensation Committee reviews risks related to executive compensation and the design of compensation programs, plans and arrangements. The Governance and Nominating Committee manages risks associated with corporate governance and Board composition and procedures. The Science Committee supports the Board’s oversight of risks related to our research and development, or R&D, organization.

Transactions with Related Persons

We maintain a written “Policy Regarding Related Person Transactions.” Under this policy, the Audit and Compliance Committee or, in time sensitive instances, the chair of the Audit and Compliance Committee, has responsibility for reviewing and approving or ratifying any transaction in which we and any of our directors, director nominees, executive officers or 5% stockholders and their immediate family members are participants, or in which such persons have a direct or indirect material interest, as provided under SEC rules. In reviewing transactions, the committee or the chair considers all of the relevant facts and circumstances, and approves only those transactions that the committee or the chair in good faith determines to be in, or not inconsistent with, the best interests of us and our stockholders. During fiscal 2017 and 2016, there were no such related-person transactions.

Communications with Directors

Stockholders and other interested parties may communicate directly with the Board, the independent directors, the Chairman of the Board, any other group of directors or any individual director by writing to such group or individual at the following address:

Name(s) of Director(s), Group of Directors or Board of Directors

c/o Company Secretary

pSivida Corp.

480 Pleasant Street

Watertown, MA 02472

United States

Our Corporate Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board.

Stockholder Nominations for Director

The Governance and Nominating Committee will consider written stockholder recommendations for candidates for the Board, which recommendations should be delivered or mailed, postage prepaid, to:

Company Secretary

pSivida Corp.

480 Pleasant Street

Watertown, MA 02472

United States

Stockholder recommendations must include certain relevant information concerning the candidate, the stockholder making the recommendation and any beneficial owner on whose behalf the recommendation is made. The required information is set forth in our Stockholder Nomination Policy, available on the “Investor” section of our website at www.psivida.com under “Corporate Governance—Governance Overview.”

The Governance and Nominating Committee will evaluate candidates for director who are recommended by stockholders on the same basis as candidates recommended by other sources. Considerations include the Governance and Nominating Committee’s discretionary assessment of the skills represented and required on the Board, and an evaluation of candidates against the standards and qualifications set forth in our Corporate Governance Guidelines and criteria approved by the Board from time to time. We do not have a formal policy with respect to diversity, although we seek to have a Board that reflects a range of talents, ages, skills, viewpoints, professional experience, educational backgrounds, expertise, genders and ethnicities. The Governance and Nominating Committee will determine whether to interview any candidate in its sole discretion.

Code of Business Conduct

We have adopted a Code of Business Conduct applicable to each of our officers, directors and employees, and consultants and contractors to, us and our subsidiaries, including our principal executive officer and principal financial officer. The Code of Business Conduct is a set of policies on key integrity issues that requires our representatives to act ethically and legally. It includes policies with respect to conflicts of interest, compliance with laws, insider trading, corporate opportunities, competition and fair dealing, discrimination and harassment, health and safety, record-keeping, confidentiality, protection and proper use of assets, payments to government personnel and reports to and communications with the SEC and the public.

We intend to disclose any future amendments to, or waivers from, the Code of Business Conduct that affect our directors or senior financial and executive officers within four business days of the amendment or waiver by posting such information on the website address and location specified above.

Audit and Compliance Committee Report

As more fully described in its charter, the Audit and Compliance Committee oversees our financial reporting process on behalf of the Board. Our management is responsible for our financial reporting process, including assuring that we develop and maintain adequate financial controls and procedures, and assess compliance therewith. Our independent registered public accounting firm, Deloitte & Touche LLP (“Deloitte”) is responsible for performing an audit of the effectiveness of our internal control over financial reporting in conjunction with an audit of the consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), and issuing its opinions on the financial statements and the effectiveness of internal control over financial reporting.

The committee reviewed and discussed our audited consolidated financial statements for the fiscal year ended June 30, 2017 with our management and Deloitte. The committee also reviewed and discussed with Deloitte the audited financial statements and the matters required by PCAOB Auditing Standard No. 1301,Communications withAudit Committees. The committee met with Deloitte, with and without management present, to discuss the results of their examinations, their evaluation of our internal controls, and the overall quality of our financial reporting.

The committee discussed with Deloitte the firm’s independence and received from Deloitte and reviewed the written disclosures and the letter required by PCAOB Ethics and Independence Rule 3526 (Communication with Audit Committees Concerning Independence). The committee considered whether Deloitte’s provision ofnon-audit services to us is compatible with Deloitte’s independence and concluded that Deloitte is independent from our company and our management.

Based on the above-referenced reviews and discussions with our management and Deloitte, the Audit and Compliance Committee recommended to the Board that our audited consolidated financial statements be included in our Annual Report on Form10-K for the year ended June 30, 2017, for filing with the Securities and Exchange Commission (“SEC”).

Submitted by

Audit and Compliance Committee

Michael Rogers

James Barry

Kristine Peterson

Beneficial Ownership

At the close of business on November 10, 2017, there were 45,256,999 shares of our common stock issued and outstanding and entitled to vote. On November 10, 2017, the closing price of our common stock as reported on the Nasdaq Global Market was $1.38 per share.

The following table sets forth certain information relating to the beneficial ownership of our common stock as of November 10, 2017 by:

each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding shares of common stock;

each of our directors;

each of our Named Executive Officers (as defined below); and

all of our current directors and executive officers as a group.

Unless otherwise indicated, the address for each of the beneficial owners listed below is: c/o pSivida Corp., 480 Pleasant Street, Watertown, MA 02472, United States.

| | | | | | | | |

Beneficial Owner | | Aggregate Number of

Shares Beneficially

Owned(1) | | | Percent of Shares

Beneficially Owned | |

5% or Greater Beneficial Owner: | | | | | | | | |

Perceptive Advisors LLC 51 Astor Place, 10th Floor New York, NY 10003 | | | 2,279,706 | | | | 5.04 | % |

| | |

Directors and Executive Officers: | | | | | | | | |

David J. Mazzo | | | 435,500 | | | | * | |

Nancy Lurker | | | 269,200 | | | | * | |

Michael Rogers | | | 310,000 | | | | * | |

Douglas Godshall | | | 160,000 | | | | * | |